Non-cash Items Are ______ That ____ Cash Flow.

Current liabilities minus current assets. Reviewed by Dheeraj Vaidya CFA FRM.

Ch 11 Act 210 Flashcards Quizlet

You need to sign up for a Lumovest subscription in order to join discussions.

. While they may not impact the net cash flow of the business these expenses impact the bottom-line of the income statement and result in lower reported earnings. When a company buys an asset or incurs an expense but instead of using cash writes a promissory note or takes over an existing loan the company is involved in a non. Items that appear in the cash flow statement but have no Using four examples May have made a loss or much lower profit because of all the non-cash Statement of Cash Flows expenses and changes in net position but do not provide or use cash.

In the example we Items on the cash flow statement. Do not directly affect. Remember not to double count.

An organization incurs non-cash expenses against balance sheet non-cash items. Non-cash expense is a charge against earnings of the company which does not involve cash outflow. Non-cash items are referred to as those entries on a cash flow statement or income statement that do not involve actual cash transactions.

Non-cash items do not affect. These non-cash items are charged as expenses in the income statement. In other words these are expenses that are listed in an income statement that do not involve cash payment.

The exclusion of non-cash transactions from the cash flow statement is consistent with the objective of a cash flow statement as these items do into involve cash flows in the current period. What are non-cash transactions on the cash flow statement. Depreciation and amortization are the two most common examples of noncash items.

There are many types to watch out for but the most common examples include. In accounting noncash items are financial items such as depreciation and amortization that are included in the business net income but which do not affect the cash flow. The cash flow statement then takes a starting Total expenses figure from the Income statement and then adds back the individual noncash expense items that are part of the Income statement expense total.

On the December 31 2019 statement of financial position the respective items were 137000 and 2568000. However some non-cash investing and financing activities may be much important for the users of financial statements because they may have a significant impact on the current and future performance in terms of revenues profits and the. Well learn how to treat non-cash items in this lesson.

Non-cash transactions are investing and financing-related transactions that do not involve the use of cash or a cash equivalent. Cash Flow from Operations Cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from. Were gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows.

Non-cash items are _____ that ____ cash flow. Non-cash items are useful for recording or tracking the wear and tear of assets or the changes taking. Hence it is added back.

Net income is adjusted in the Cash Flow from Operations section of the cash flow adding back to net income all non-cash charges and subtracting all non-cash income. Non-Cash Expense refers to those expenses which are reported in the income statement of the company for the period under consideration but does not have any relation with the cash ie they are not paid in the cash by the company and includes expenses like depreciation etc. The items in the cash flow statement are not all actual cash flows but reasons why cash flow is different from profit Depreciation expense reduces profit but does not impact cash flow it is a non-cash expense.

So some examples of non cash items would be the purchase of long term assets by issuing a. Similarly if the starting point profit is above interest and tax in the income statement then. Add back non-cash expenses and subtract out non-cash incomes.

Net working capital equals _____. Article by Sayantan Mukhopadhyay. The last item or bottom line on the income statement is typically the _____ net income.

The first step to bridge from earnings to cash flow is to neutralize non-cash items. What is a Non-Cash Item. Were gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows.

Accrued charges Non-cash incomes are. Cash flow subtotals may be incomplete and not useful for equity analysis unless certain flows arsing from non-cash transactions are included. Examples of non-operating cash flow can include taking out a loan issuing new stock and a self-tender defense among many others.

Because non-cash transactions can have generally later real cash flows it is important that this real flow is classified in a consistent manner. The short run is a period when there are _____ costs. Gain on sale of fixed assets Equity in earnings of affiliated companies.

As you can see the 500 depreciation expense is actually a non-cash item and the capital cost is recorded only once on the cash flow statement. Like debtors is the money of the business that is owned by the company but has not been received. When it is earned or accrued.

In the statement of financial position on December 31 2018 common stock capital was 120000 and capital surplus was 2289000. If a cash dividend of 149500 was paid in 2019 what was the shareholders. Non-cash items do not affect.

It starts with net income or loss followed by additions to or subtractions from that amount to adjust the net income to a total cash flow figure. Cash flow to shareholders. Net cash inflow is then the difference between the.

So some examples of non cash items would be the purchase of long term. According to GAAP when is income reported. Adjusted EBITDA differs from the most comparable GAAP measure cash flows from operating activities primarily because it does not include changes in non-cash working capital other cash payments related to operating activities stock-based compensation expense other non-cash items interest expense interest and other income expense and current income taxes.

Statement of cash flows reports only those operating investing and financing activities that affect cash or cash equivalents. Earnings per share c. In financial accounting a Cash Flow Statement also known as Statement of Cash Flow is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities.

Items listed under non-operating cash flow are usually non. Total assets minus total liabilities b. A non-cash item is an entry on an income statement or cash flow statement correlating to expenses that are essentially just accounting entries rather than actual movements of cash.

List of the Most Common Non-Cash Expenses. Current assets minus current liabilities c. Essentially the cash flow statement is concerned with the.

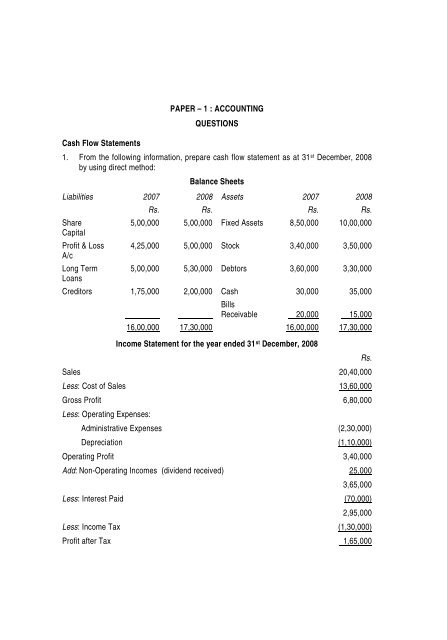

Paper 1 Accounting Questions Cash Flow Statements 1

0 Response to "Non-cash Items Are ______ That ____ Cash Flow."

Post a Comment